This information will wreck down each element of POS gadget pricing to provide you with a transparent and life like figuring out of the funding required. We will be able to discover the in advance bills, habitual per 30 days charges, and hidden prices you may come across. Whether or not you’re opening a small espresso cart, a boutique retail shop, or a multi-location eating place, this complete breakdown will equip you to funds successfully and make a choice a gadget that now not simplest suits your budget but additionally powers your expansion.

Key Takeaways

- No Unmarried Worth: POS gadget prices range dramatically in line with your small business sort, length, and required options. Be expecting a variety from as low as a couple of hundred greenbacks in advance for a fundamental cellular setup to over $10,000 for a posh, multi-terminal gadget for a big eating place.

- 3 Core Price Elements: The full value is a mixture of instrument (per 30 days or annual subscription charges, in most cases $0 to $300+ per 30 days according to sign up), {hardware} (one-time prices from $50 for a easy card reader to $2,000+ for an entire terminal package), and cost processing (a proportion of each and every transaction, typically 2.5% to three.5%).

- Tool is the Driving force: The most important long-term charge is in most cases the instrument subscription. Trendy POS programs are SaaS (Tool as a Carrier) merchandise, the place you pay a habitual charge for get right of entry to to the instrument, updates, and fortify. “Unfastened” POS instrument virtually all the time comes with necessary, and ceaselessly larger, cost processing charges.

- {Hardware} is a One-Time Price: Whilst {hardware} calls for an preliminary funding, you personal it outright. Prices rely on what you want, from a easy iPad and card reader to a complete suite together with receipt printers, barcode scanners, and money drawers.

- Cost Processing is Non-Negotiable: Those charges are how card networks and processors earn cash. The construction is usually a easy flat fee (e.g., 2.6% + 10¢ according to transaction) or a extra advanced style like Interchange-Plus. Those charges are an enduring operational charge.

- eCommerce Integration is An important: For any enterprise with a web-based presence, the POS gadget should combine seamlessly along with your site. This synchronization of stock and gross sales knowledge between your bodily shop and your on-line shop, most likely one constructed with an impressive instrument just like the Elementor WooCommerce builder, is very important for contemporary retail.

Bankruptcy 1: Deconstructing POS Gadget Prices: The Core Elements

To know the whole charge of possession for a POS gadget, you want to damage it down into its 3 elementary pillars: instrument, {hardware}, and cost processing. Each and every element has its personal pricing fashions and variables that give a contribution for your total expense.

Tool Prices: The Brains of the Operation

POS instrument is the command middle. It’s the interface your workforce makes use of to ring up gross sales, the backend the place you set up stock, and the database that retail outlets your buyer knowledge. Up to now, companies would purchase a instrument license for a big, one-time charge. Lately, the trade has overwhelmingly shifted to a subscription-based SaaS style.

The Subscription Type (SaaS)

That is the most typical pricing construction for contemporary POS programs. You pay a habitual charge, both per 30 days or every year, for each and every sign up or terminal.

- What It Contains: The subscription in most cases covers use of the instrument, ongoing updates with new options and safety patches, cloud backup to your knowledge, and get right of entry to to buyer fortify.

- Standard Worth Vary:

- Fundamental Plans: $0 – $69 per 30 days. Those plans are appropriate for terribly small companies and ceaselessly include obstacles. The “unfastened” plans typically lock you into the supplier’s cost processing.

- Same old/Expansion Plans: $69 – $199 per 30 days according to sign up. That is the candy spot for many small to medium-sized companies (SMBs), providing powerful stock control, reporting, and CRM options.

- Top class/Professional Plans: $199 – $350+ per 30 days according to sign up. Those are designed for higher operations, multi-location companies, or the ones wanting extremely specialised options like complex analytics, loyalty methods, or open API get right of entry to.

- Main Suppliers:

- Lightspeed: Provides specialised POS programs for retail and eating places, with plans beginning round $69/month.

- Toast: A cafe-focused POS with a variety of {hardware} and instrument choices. Plans can vary from a unfastened starter package (with processing commitments) to custom-quoted undertaking answers.

- Shopify POS: Designed for companies that promote each on-line and in-person. The “Lite” plan is integrated with fundamental Shopify eCommerce plans, whilst the “Professional” model prices an extra per 30 days charge and unlocks extra complex retail options. This can be a top instance of a gadget constructed to unify on-line and offline gross sales.

On-Premise (Authorized) Tool

Although much less not unusual now, some suppliers nonetheless be offering a standard instrument license. You pay a big, one-time charge to possess the instrument license and set up it by yourself native servers and {hardware}.

- What It Contains: The license to make use of the instrument indefinitely. Give a boost to, updates, and upkeep are virtually all the time further and require an ongoing annual contract.

- Standard Worth Vary: The in advance charge may also be really extensive, starting from $1,000 to $5,000+ according to terminal.

- Professionals & Cons: The principle merit is possession. The drawback is a better preliminary charge and the duty for keeping up your personal {hardware}, knowledge safety, and backups. This style is changing into increasingly more uncommon as cloud-based programs be offering extra flexibility and no more IT overhead.

“Unfastened” POS Tool

A number of suppliers, maximum significantly Sq., have constructed their enterprise style on providing unfastened core POS instrument. That is a ravishing choice for brand new and small companies, however it’s the most important to know the catch.

- How It Works: The instrument itself is unfastened to make use of, however you might be required to make use of the supplier’s personal cost processing products and services. They make their cash from the transaction charges, that could be somewhat larger than what you have to negotiate with a third-party processor.

- Obstacles: The unfastened tier in most cases contains all of the necessities for a brand new enterprise. On the other hand, extra complex options like loyalty methods, e mail advertising, or complex stock control are ceaselessly locked at the back of paid per 30 days add-ons. As an example, Sq. for Retail and Sq. for Eating places have each unfastened and paid tiers.

{Hardware} Prices: The Bodily Touchpoints

POS {hardware} is the whole lot you and your shoppers bodily have interaction with throughout a transaction. The prices listed here are essentially in advance, and the quantity you spend relies totally at the scale and nature of your small business.

The Necessities: Construction Your Checkout Counter

Here’s a breakdown of the average {hardware} elements and their standard one-time prices:

| {Hardware} Element | Description | Reasonable Price Vary |

| POS Terminal/Sign in | The principle instrument operating the POS instrument. It is a proprietary all-in-one terminal, an iPad, or any other pill. | $300 – $1,500 |

| Credit score Card Reader | Processes credit score and debit playing cards. Generally is a easy cellular swiper, a countertop terminal, or an built-in instrument. | $50 – $500 |

| Receipt Printer | Prints paper receipts for patrons. Thermal printers are the most typical sort. | $200 – $400 |

| Money Drawer | A safe drawer for storing money, exams, and cash. In most cases connects to the receipt printer to open mechanically. | $100 – $250 |

| Barcode Scanner | Scans UPC barcodes on merchandise to briefly upload them to a sale. Very important for many retail companies. | $150 – $400 |

A fundamental {hardware} package for a unmarried checkout counter, together with an iPad stand, card reader, receipt printer, and money drawer, will in most cases charge between $800 and $1,200.

Not obligatory & Business-Explicit {Hardware}

Relying on your small business, you could want further specialised apparatus:

- Buyer-Going through Show: A small display screen that faces the client, appearing them the transaction main points and taking into account virtual signatures or guidelines. Price: $200 – $600.

- Kitchen Show Gadget (KDS): A display screen positioned within the kitchen that shows incoming orders for eaterie workforce, changing paper tickets. Price: $1,000 – $2,500 according to display screen.

- Weight Scales: For companies that promote pieces by means of weight, like delis, frozen yogurt retail outlets, or grocery retail outlets. Those should combine with the POS. Price: $300 – $800.

- Self-Carrier Kiosks: Freestanding terminals that permit shoppers to position their very own orders. More and more fashionable in quick-service eating places. Price: $2,000 – $5,000+ according to kiosk.

Sourcing Your {Hardware}: To Package deal or To not Package deal?

You typically have two choices for obtaining {hardware}:

- Purchase out of your POS supplier: Maximum suppliers promote {hardware} this is assured to be appropriate with their instrument. They ceaselessly be offering handy bundles. That is the very best and most secure choice.

- Purchase from a 3rd occasion: You’ll occasionally lower your expenses by means of sourcing appropriate {hardware} your self. On the other hand, you run the chance of compatibility problems, and your POS supplier would possibly not be offering fortify for {hardware} they didn’t promote you.

Some suppliers additionally be offering leasing choices, which lowers the in advance charge however will increase the whole long-term expense. For many SMBs, buying the {hardware} outright is the extra financially sound choice.

Cost Processing Charges: The Price of Each Swipe, Dip, and Faucet

That is arguably essentially the most advanced and least understood a part of POS costing. Each time a buyer will pay with a card, a small proportion of that transaction is deducted as a charge. Those charges are an enduring, ongoing operational expense.

Figuring out the Pricing Fashions

There are 3 primary fashions for cost processing. The only you select may have an important have an effect on to your per 30 days prices.

- Flat-Charge Processing:

- The way it Works: You pay a unmarried, mounted proportion plus a small flat charge for each transaction, irrespective of the cardboard sort (e.g., Visa, Amex, debit, rewards card).

- Instance: Sq.’s same old in-person fee is two.6% + 10¢. Shopify Bills is identical.

- Professionals: Easy, clear, and predictable. Nice for small companies or the ones with a decrease moderate price tag length.

- Cons: Will also be dearer for high-volume companies in comparison to Interchange-Plus.

- Interchange-Plus Processing:

- The way it Works: This style breaks the cost into two portions: the “Interchange” charge (a wholesale fee that is going to the card-issuing financial institution) and the “Plus” (the processor’s markup).

- Instance: A processor would possibly quote you “Interchange + 0.20% + 15¢”.

- Professionals: Usually essentially the most clear and cost-effective style for companies processing over $10,000 per 30 days.

- Cons: Extra advanced. Your per 30 days statements shall be tougher to learn, because the interchange fee varies for loads of various card varieties.

- Tiered Processing:

- The way it Works: The processor teams transactions into tiers (e.g., “Certified,” “Mid-Certified,” “Non-Certified”) and assigns a unique fee to each and every.

- Professionals: Can seem easy at the floor.

- Cons: That is the least clear style. The processor has complete keep an eye on over which transactions fall into which tiers, ceaselessly pushing extra transactions into the higher-cost tiers. It’s typically advisable to steer clear of this style.

Different Processing-Similar Charges to Watch For

Past the per-transaction fee, you may additionally come across:

- Per month Rate: A flat charge for the service provider account, in most cases $10 – $30.

- PCI Compliance Rate: An annual charge to verify your gadget meets the Cost Card Business Knowledge Safety Same old. Price: ~$100 according to 12 months.

- Chargeback Rate: A penalty charge ($15 – $25) charged every time a buyer disputes a transaction.

- Terminal Rate: A per 30 days apartment charge in case you are leasing your bank card terminal.

Bankruptcy 2: Elements Influencing the Ultimate Worth Tag

Now that we’ve lined the core elements, let’s have a look at the business-specific elements that can carry or decrease your general charge.

Your Trade Kind and Business

A POS gadget isn’t a one-size-fits-all product. Other industries have massively other wishes, and POS suppliers construct specialised instrument to satisfy them.

Retail POS

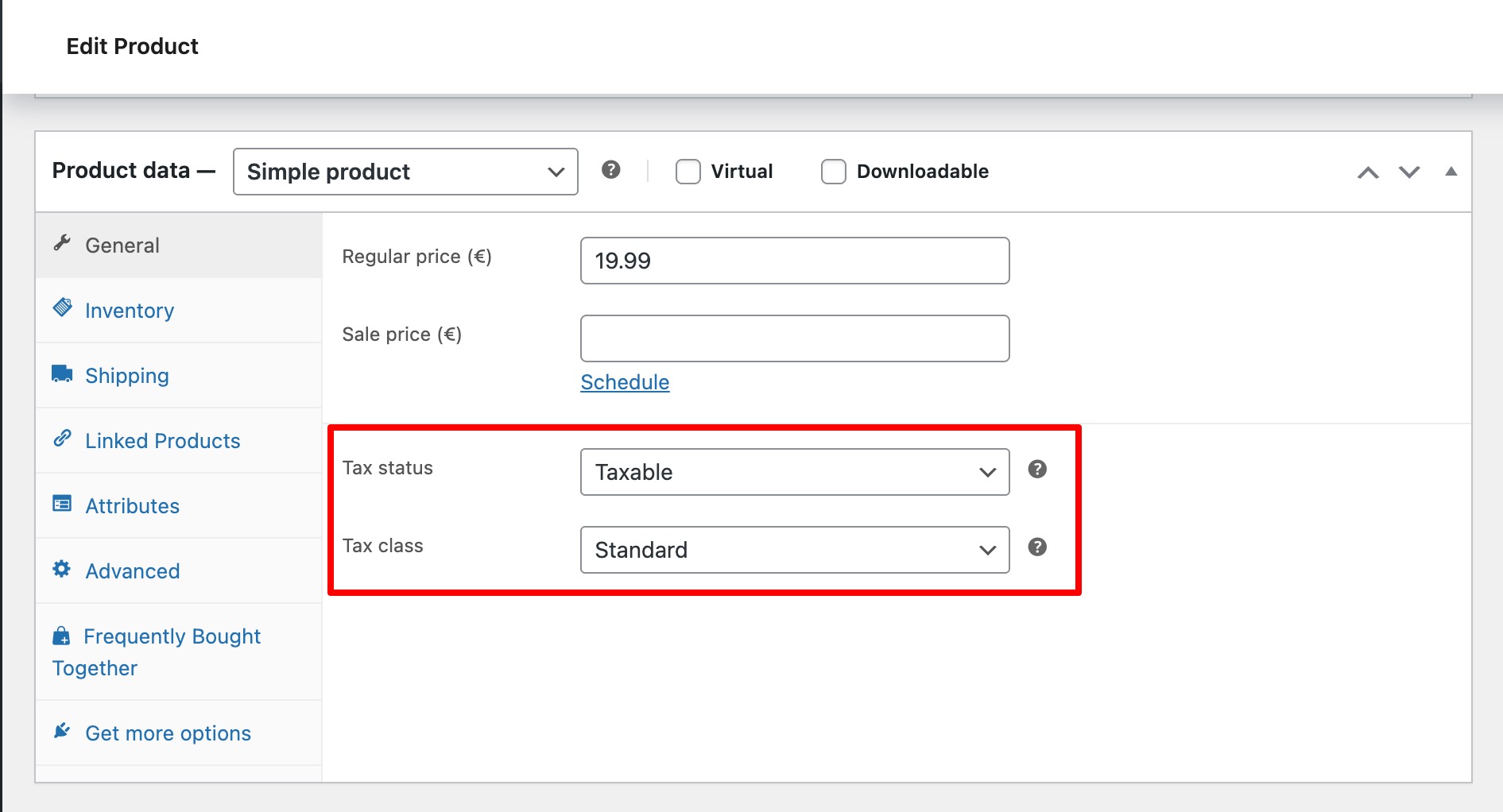

- Key Options: Sturdy stock control (monitoring variants like length and colour), barcode scanning, buyer profiles, loyalty methods, and eCommerce integration.

- Price Affect: Retail POS programs are ceaselessly priced according to sign up. A rising retail enterprise will even wish to spend money on barcode scanners and doubtlessly label printers.

Eating place POS

- Key Options: Desk and seating control, customizable ground plans, order modifiers (e.g., “no onions”), invoice splitting, tipping capability, and KDS integration. Fast-service eating places (QSRs) want velocity, whilst full-service eating places want detailed desk control.

- Price Affect: Eating place programs may also be dearer because of those specialised options. The will for a couple of terminals (host stand, bar, server stations) and kitchen {hardware} like a KDS can considerably building up in advance prices.

Take a look at this video on create a site to your eating place, which is a key step after putting in place your in-house POS: https://www.youtube.com/watch?v=QKd7d6LueH4

Carrier-Primarily based Trade POS (e.g., Salons, Spas)

- Key Options: Appointment reserving and calendar control are paramount. Different options come with worker scheduling, fee monitoring, and buyer historical past.

- Price Affect: The fee is ceaselessly pushed by means of the collection of workforce contributors or calendars you want to control, along with the collection of terminals.

Choice of Places and Terminals

This can be a easy however vital charge multiplier. If in case you have one checkout counter, you pay for one instrument license and one set of {hardware}. If in case you have 3 checkout counters and a again place of work station, you could want 4 instrument licenses and 3 complete {hardware} bundles. Companies with a couple of places want a POS that provides centralized control, permitting you to view gross sales and stock knowledge throughout all retail outlets from a unmarried dashboard. This multi-location capacity virtually all the time comes with a higher-tier, dearer instrument plan.

Required Options and Integrations

The options you want will immediately have an effect on which instrument plan you select. A fundamental plan would possibly quilt gross sales and bills, however you’ll wish to improve for extra complex capability.

- Core Options (In most cases Incorporated):

- Gross sales processing

- Fundamental stock monitoring

- Buyer profiles

- Finish-of-day reporting

- Complex Options (Continuously in Upper Tiers or as Upload-Ons):

- Loyalty Techniques: Rewarding repeat shoppers with issues or reductions.

- E-mail Advertising: Construction buyer lists and sending promotional emails. Some POS programs be offering this, however integrating with a devoted provider or a site’s integrated answer like Ship by means of Elementor may also be extra robust.

- Complex Analytics: Deep-dive stories on gross sales tendencies, worker efficiency, and benefit margins.

- Worker Control: Time clocks, shift scheduling, and role-based permissions.

The All-Essential eCommerce Integration

For any trendy enterprise, omnichannel is the purpose: growing a unbroken buyer revel in whether or not they store in-store or on-line. That is inconceivable and not using a POS gadget that deeply integrates along with your eCommerce platform.

- Why It’s Very important: The mixing mechanically syncs knowledge between your bodily shop and your site.

- Stock Sync: Whilst you promote a product in-store, the inventory depend to your site updates straight away, combating you from promoting pieces you don’t have.

- Gross sales Knowledge Sync: All gross sales, whether or not on-line or in-person, are consolidated into one reporting gadget, providing you with a holistic view of your small business efficiency.

- Buyer Knowledge Sync: Create unified buyer profiles. A buyer should buy on-line and go back in-store, and your workforce may have their complete acquire historical past.

As internet construction skilled Itamar Haim states, “The most important mistake a contemporary store could make is treating their bodily shop and their on-line shop as separate entities. Your POS gadget must be the central worried gadget that connects them. The purpose is a frictionless glide of knowledge. A buyer shouldn’t be penalized for which channel they make a choice to buy on, and that calls for a strong integration between your checkout counter and your site, particularly a extremely custom designed one constructed with a versatile platform like Elementor for WordPress.”

- Price Affect: This option is never to be had in unfastened or fundamental POS plans. You’re going to virtually undoubtedly want a mid-tier or top class subscription to release powerful eCommerce integration. The fee is not only within the POS plan, but additionally in making sure you’ve gotten a succesful eCommerce platform to your site, like WooCommerce, to connect with.

For a have a look at construct the eCommerce site that your POS will hook up with, this video is a smart start line: https://www.youtube.com/watch?v=gvuy5vSKJMg

Bankruptcy 3: Actual-International Price Eventualities

Let’s put this all in combination and have a look at some pattern charge breakdowns for various kinds of companies. Those are estimates as an instance the variability of funding.

Situation 1: The Small Espresso Cart

This enterprise wishes a easy, cellular, and low cost answer.

- {Hardware}:

- iPad: $329 (proprietor’s current instrument may well be used)

- Sq. Stand with Reader: $149

- Money Drawer: $129

- General In advance {Hardware} Price: ~$278 – $607

- Tool:

- Sq. POS (Unfastened Plan): $0/month

- Cost Processing:

- Sq. Same old Charge: 2.6% + 10¢ according to transaction

- Estimated First-Yr Price (except processing charges): ~$278 – $607

Situation 2: The Boutique Retail Retailer

This single-location shop wishes powerful stock control and desires to promote on-line.

- {Hardware} (1 Sign in):

- iPad: $449

- Countertop Stand: $199

- Card Reader: $299

- Receipt Printer: $299

- Barcode Scanner: $229

- Money Drawer: $139

- General In advance {Hardware} Price: ~$1,614

- Tool:

- Lightspeed Retail (Same old Plan): $119/month

- General Annual Tool Price: $1,428

- Cost Processing:

- Lightspeed Bills: 2.6% + 10¢ according to transaction

- Estimated First-Yr Price (except processing charges): ~$3,042

Situation 3: The Complete-Carrier Eating place

This eating place has a bunch stand, a bar, two server stations, and a kitchen.

- {Hardware}:

- 4 x All-in-One Touchscreen Terminals: 4 x $999 = $3,996

- 4 x Card Readers: Incorporated with terminals

- 2 x Receipt Printers (Bar, Host): 2 x $299 = $598

- 1 x Kitchen Show Gadget (KDS): $1,200

- 2 x Money Drawers: 2 x $139 = $278

- General In advance {Hardware} Price: ~$6,072

- Tool:

- Toast (Necessities Plan): $165/month

- General Annual Tool Price: $1,980

- Cost Processing:

- Customized fee negotiated with Toast (Interchange-Plus style most likely)

- Estimated First-Yr Price (except processing charges): ~$8,052

Bankruptcy 4: Hidden Prices and Lengthy-Time period Issues

The in advance {hardware} and per 30 days instrument charges are the obvious prices, however there are different bills to funds for over the lifetime of your gadget.

- Setup and Set up: Whilst many trendy iPad-based programs are DIY, extra advanced programs would possibly require skilled on-site set up, which is able to charge a number of hundred to over one thousand greenbacks.

- Coaching: Getting your workforce on top of things on a brand new gadget takes time, which is cash. Some suppliers be offering unfastened on-line assets, whilst others rate for devoted coaching periods.

- Buyer Give a boost to: Fundamental fortify (e mail, chat) is typically integrated for your subscription. On the other hand, 24/7 telephone fortify or get right of entry to to a devoted account supervisor would possibly require a top class plan or an extra charge.

- Upload-On Modules: Pay attention to the options that don’t seem to be integrated for your core plan. Need to upload a loyalty program, on-line ordering, or reward card capability? Those ceaselessly include their very own per 30 days charges.

- {Hardware} Upgrades & Replacements: {Hardware} doesn’t ultimate eternally. You must funds to interchange elements like printers or scanners each 3-5 years. Era additionally evolves; you could wish to improve a card reader to simply accept a brand new cost sort.

- PCI Compliance: Failing to deal with PCI compliance may end up in hefty fines within the match of an information breach. Whilst your POS supplier is helping with this, without equal duty is yours. Be sure to perceive their necessities and any related annual charges.

Conclusion: A POS Gadget is an Funding in Your Trade’s Long term

Figuring out how a lot a POS gadget prices calls for a radical analysis of your small business’s present and long run wishes. It’s now not about discovering the most cost effective choice, however about discovering the most productive worth. A easy cellular setup with unfastened instrument may well be absolute best for a marketplace stall, however it will cripple a hectic eating place.

When budgeting, assume past the preliminary value. Believe the long-term instrument charges, the inevitable charge of cost processing, and the options that can in fact let you run your small business extra successfully and develop your gross sales. The fitting POS gadget will prevent time on administrative duties, supply beneficial knowledge about your gross sales tendencies, and let you construct higher relationships along with your shoppers.

Most significantly, view your POS as a part of a bigger ecosystem. It’s the operational core that should hook up with all different portions of your small business, particularly your on-line presence. A formidable site, constructed on a versatile platform like Elementor, is your virtual storefront. Making sure your POS can keep up a correspondence with it seamlessly is the important thing to succeeding within the trendy, omnichannel retail panorama.

Often Requested Questions (FAQ)

1. What’s the most cost-effective approach to get a POS gadget? Probably the most reasonably priced access level is in most cases a supplier like Sq. that provides unfastened instrument and a low cost cellular card reader (ceaselessly the primary one is unfastened). You might use your personal smartphone or pill, minimizing in advance {hardware} prices. The main charge would then be the flat-rate cost processing charges.

2. Can I take advantage of my very own iPad or pc for a POS gadget? Sure, most present cloud-based POS suppliers have apps which can be designed to run on not unusual {hardware} like iPads, Android capsules, and even in a internet browser on a PC or Mac. It is a nice approach to save on preliminary {hardware} prices. At all times take a look at the supplier’s {hardware} compatibility record prior to you devote.

3. Do I’ve to make use of the POS supplier’s cost processing? It relies. Some suppliers, like Sq. and Shopify POS (with Shopify Bills), are built-in cost processors, that means their instrument and processing are a unmarried bundle. Others, like Lightspeed, would possibly be offering their very own processing but additionally will let you combine with a collection of third-party processors. The use of the in-house processor ceaselessly leads to higher charges and more effective fortify.

4. What are PCI compliance charges? The Cost Card Business Knowledge Safety Same old (PCI DSS) is a suite of safety requirements designed to offer protection to cardholder knowledge. All companies that settle for card bills should be PCI compliant. Some processors rate an annual charge (round $100) to assist quilt the prices of validation and fortify to verify your small business meets those requirements.

5. How a lot must I be expecting to pay in bank card processing charges? For many small companies the usage of a flat-rate style, you must funds for 2.5% to three.5% of your general card gross sales to move towards processing charges. For on-line transactions, the velocity is in most cases somewhat larger because of larger fraud possibility.

6. What’s the variation between a POS gadget and a straightforward bank card reader? A bank card reader is only one piece of {hardware} that processes bills. A POS gadget is all the instrument platform that now not simplest processes the sale but additionally manages stock, tracks buyer knowledge, supplies gross sales analytics, manages workers, and extra. This can be a complete enterprise control instrument.

7. How necessary is eCommerce integration for a POS gadget? It’s severely necessary for any enterprise that sells, or plans to promote, each in-person and on-line. With out it, you might be necessarily operating two separate companies without a communique between them, resulting in stock mistakes, deficient buyer reports, and fragmented gross sales knowledge.

8. Are there POS programs without a per 30 days charges? Sure, suppliers like Sq. be offering POS instrument without a per 30 days subscription charge for his or her fundamental plan. On the other hand, there is not any such factor as a in point of fact “unfastened” POS. Those firms make their cash thru cost processing charges, and complex options virtually all the time require subscribing to a paid per 30 days plan.

9. How do I make a choice the correct POS gadget for my enterprise? Get started by means of defining your wishes. What trade are you in? What number of places and registers do you want? What are your “must-have” options (e.g., stock control, appointment reserving, on-line ordering)? Then, analysis suppliers specializing in your trade, evaluate their instrument plans and processing charges, and request demos to peer the instrument in motion.

10. Can a POS gadget assist with advertising? Completely. Many POS programs have integrated CRM (Buyer Courting Control) options that will let you gather buyer knowledge like names and e mail addresses. You’ll then use this information to spot your easiest shoppers, create centered e mail advertising campaigns, and arrange loyalty methods to inspire repeat enterprise.