This information is designed to demystify the method. We are going to break down the whole lot you might want to find out about calculating, amassing, and remitting gross sales tax on your on-line retailer in 2026. Whether or not you might be simply beginning your ecommerce journey with a brand new WordPress web site or scaling a longtime enterprise, this complete walkthrough will present the readability and actionable steps you might want to handle gross sales tax with confidence.

Key Takeaways

- Nexus is the Key: Your obligation to gather gross sales tax is set by “nexus,” which is a big connection to a state. This may be established by way of a bodily presence (bodily nexus) or by exceeding sure gross sales or transaction thresholds (financial nexus).

- Charges Are Hyper-Native: Gross sales tax isn’t only a single state price. You should account for a posh mixture of state, county, metropolis, and particular district taxes, which may change incessantly. The shopper’s delivery tackle normally determines the precise price.

- Not All Merchandise Are Taxed Equally: The taxability of merchandise varies extensively. What’s taxable in a single state could be exempt in one other. You should perceive the precise guidelines on your merchandise (e.g., clothes, digital items, meals) in each state the place you’ve nexus.

- Registration is Obligatory: Earlier than you’ll be able to accumulate a single cent of gross sales tax, it’s essential to register for a gross sales tax allow in every state the place you’ve nexus. Amassing tax with out a allow is illegitimate.

- Automation is Your Finest Buddy: Manually monitoring nexus, calculating charges for hundreds of jurisdictions, and managing submitting deadlines is almost inconceivable at scale. Automated gross sales tax software program is an important device for any critical ecommerce enterprise to make sure accuracy and compliance.

- Market Facilitator Legal guidelines Shift Duty: Should you promote on marketplaces like Amazon or Etsy, they’re usually chargeable for amassing and remitting gross sales tax in your behalf. Nevertheless, you might be nonetheless chargeable for gross sales made by way of your individual web site, akin to one constructed with the Elementor WooCommerce Builder.

The Basis: Understanding Gross sales Tax Nexus

On the coronary heart of all gross sales tax compliance is a single idea: nexus. Consider nexus because the authorized time period for a connection between what you are promoting and a state that’s substantial sufficient to require you to register, accumulate, and remit gross sales tax there. When you have nexus in a state, you might be legally obligated to behave as that state’s tax collector for gross sales made to clients inside its borders.

For many years, this was a comparatively easy matter. Nevertheless, a landmark Supreme Court docket case in 2018 essentially modified the panorama for on-line companies.

The Evolution of Nexus: From Bodily to Financial

Understanding how nexus is established is the primary and most important step in managing your gross sales tax obligations. It has developed from an easy bodily presence take a look at to a way more advanced financial one.

Bodily Nexus: The Conventional Normal

For a very long time, the rule was easy. You solely needed to accumulate gross sales tax in states the place you had a bodily presence. That is nonetheless a major option to set up nexus. Widespread triggers for bodily nexus embrace:

- An Workplace or Retailer: Having a bodily location, whether or not it’s a company headquarters, a retail store, or a small satellite tv for pc workplace.

- Workers: Having staff who work in a state, together with full-time, part-time, or contract staff. Even a single distant worker can create nexus.

- A Warehouse or Success Middle: Storing stock in a state is among the most typical methods on-line sellers create bodily nexus. This contains utilizing third-party logistics (3PL) companies or Amazon’s FBA program. In case your merchandise are sitting in a warehouse in a state, you’ve nexus there.

- Salespeople or Representatives: Having gross sales reps who solicit enterprise in a state.

- Attending Commerce Exhibits: In some states, repeatedly attending commerce reveals to make gross sales may also create a short lived or everlasting bodily nexus.

If any of those apply to what you are promoting, you’ve bodily nexus and should adjust to that state’s gross sales tax legal guidelines, no matter your gross sales quantity.

Financial Nexus: The Put up-Wayfair World

The sport modified utterly in 2018 with the Supreme Court docket’s resolution in South Dakota v. Wayfair, Inc. This ruling acknowledged that within the age of ecommerce, companies may have a big financial affect on a state with out having any bodily presence there.

This led to the creation of financial nexus legal guidelines, which have now been adopted by almost each state with a gross sales tax. Financial nexus is triggered when a distant vendor (a enterprise with no bodily presence) exceeds a sure threshold of gross sales and/or variety of transactions right into a state inside a 12-month interval.

Whereas the precise thresholds range by state, the most typical normal is:

- $100,000 in product sales into the state.

- OR 200 separate transactions into the state.

For instance, in case your on-line retailer, primarily based solely in Florida, sells $120,000 price of products to clients in California in a 12 months, you now have financial nexus in California. You should register to gather and remit California gross sales tax, even if in case you have no workplace, worker, or warehouse there. Some states have greater thresholds or solely use a gross sales greenback quantity, so it’s essential to examine the precise guidelines for every state.

Different Types of Nexus

Past bodily and financial nexus, some states produce other, much less widespread legal guidelines that may create a gross sales tax obligation. These embrace:

- Click on-Via Nexus: That is created while you companion with an in-state affiliate who refers clients to your web site by way of a hyperlink. Should you generate a certain quantity of gross sales from these in-state associates, you could have nexus.

- Affiliate Nexus: It is a broader class the place a connection to an in-state entity that acts on what you are promoting’s behalf (like a advertising affiliate or a restore service) can create nexus.

Whereas financial nexus has turn out to be the dominant normal for distant sellers, it’s smart to pay attention to these different varieties, as they will nonetheless apply in sure conditions.

Step-by-Step Information to Calculating Gross sales Tax

When you perceive the idea of nexus, you’ll be able to transfer on to the sensible steps of calculation and assortment. This course of requires a scientific strategy to make sure you’re compliant in every single place you’ve an obligation.

Step 1: Determine The place You Have Nexus

That is the foundational job upon which the whole lot else is constructed. You can not adjust to gross sales tax legal guidelines in the event you don’t know the place you’re required to.

Monitoring Gross sales and Transaction Quantity by State

Your first precedence is to get a transparent image of your gross sales exercise in each state. Most trendy ecommerce platforms, together with these constructed with the Elementor WooCommerce Builder, present detailed gross sales stories. It’s essential to run stories that present you two key metrics for the final 12 months, damaged down by state:

- Whole Gross Gross sales: The whole greenback worth of all gross sales shipped to clients in every state.

- Whole Variety of Transactions: The whole depend of particular person orders shipped to clients in every state.

It’s best to evaluate these numbers repeatedly, at the very least quarterly. Create a spreadsheet to match your totals in opposition to every state’s financial nexus thresholds. Whenever you see you’re approaching a threshold in a selected state—say, you’ve reached $85,000 in gross sales to Texas—it’s time to begin making ready to register.

Utilizing Nexus Examine Instruments and Questionnaires

Past simply monitoring gross sales, you might want to assess your bodily nexus footprint. Ask your self these questions for each state:

- Do I’ve an workplace, warehouse, or every other bodily location?

- Do I’ve any staff working from this state (together with distant staff)?

- Is any of my stock saved on this state (together with at a 3PL or FBA warehouse)?

- Have I or my crew traveled to this state for gross sales or commerce reveals?

Many automated gross sales tax companies supply a “nexus evaluation” device that may assist you to with this course of by connecting to your gross sales channels and figuring out the place you seemingly have obligations.

Step 2: Register for a Gross sales Tax Allow in Nexus States

After getting recognized a state the place you’ve nexus, you should register for a gross sales tax allow earlier than you’ll be able to legally accumulate gross sales tax. It’s unlawful to cost gross sales tax to clients with out being registered with the state’s taxing authority (usually referred to as the Division of Income or Board of Equalization).

The Registration Course of Defined

The registration course of is dealt with on-line by way of every state’s division of income web site. You will have to offer detailed details about what you are promoting, together with:

- Your Federal Employer Identification Quantity (EIN)

- Enterprise identify and tackle

- Enterprise entity kind (sole proprietor, LLC, company)

- Names of homeowners or company officers

- An estimate of your annual gross sales into that state

After you submit your software, the state will course of it and challenge you a gross sales tax allow quantity and a submitting frequency. There may be usually no payment to register for a allow, although a couple of states could cost a small software payment.

Timing is Essential: When to Register

The secret is to register as quickly as you affirm you’ve nexus. Don’t wait. Should you cross a state’s financial nexus threshold in October, you need to register promptly so you’ll be able to start amassing tax in your subsequent sale into that state. Ready can result in again taxes, penalties, and curiosity, which generally is a vital monetary burden.

Step 3: Decide the Appropriate Gross sales Tax Fee

That is the place gross sales tax calculation turns into actually advanced. The US doesn’t have a single nationwide gross sales tax. As a substitute, there are literally thousands of completely different taxing jurisdictions, and the speed it’s essential to cost depends upon your buyer’s exact location.

The Problem of Various Charges (State, County, Metropolis, District)

A gross sales tax price is never only a single state-level share. It’s usually a mix of a number of charges:

- State Fee: The bottom price set by the state legislature.

- County Fee: A further tax levied by the county.

- Metropolis Fee: An additional tax imposed by town authorities.

- Particular District Fee: Taxes for particular functions, akin to transportation, stadiums, or cultural arts, which may apply to very particular geographic areas.

Because of this two clients in the identical state, however in several cities and even completely different neighborhoods, may pay completely different gross sales tax charges. For instance, a buyer in a particular a part of downtown Denver may pay the Colorado state tax, the Denver county tax, the Denver metropolis tax, and a Regional Transportation District (RTD) tax, all mixed into one closing price.

Origin-Primarily based vs. Vacation spot-Primarily based Sourcing Guidelines

To complicate issues additional, states have completely different guidelines for figuring out which price to use.

- Vacation spot-Primarily based Sourcing (Most Widespread): Within the majority of states, the gross sales tax price is predicated on the customer’s delivery tackle. That is the “vacation spot” of the sale. This implies it’s essential to be capable to calculate the exact, mixed price for each single tackle you ship to in your nexus states.

- Origin-Primarily based Sourcing (Much less Widespread): In a handful of states (like Texas and California, with some modifications), the speed is predicated on the vendor’s location or “origin.” For a distant vendor, this may be advanced. The principles range, but it surely could be primarily based on the situation from which the order is fulfilled or one other outlined enterprise location throughout the state.

For many on-line sellers, the destination-based mannequin is the one you’ll encounter most frequently, and it’s the one which makes guide calculation nearly inconceivable.

The best way to Discover Correct, Up-to-Date Charges

Provided that there are over 13,000 taxing jurisdictions within the U.S. and charges can change quarterly and even month-to-month, counting on a manually maintained spreadsheet is a recipe for catastrophe. The one dependable strategies are:

- State Division of Income Web sites: States present tax price tables, however these could be cumbersome and troublesome to translate into exact, address-level calculations.

- Gross sales Tax Fee APIs: Essentially the most dependable resolution is to make use of an automatic tax calculation service. These companies preserve a real-time database of each price and rule within the nation. When a buyer enters their delivery tackle at checkout, your ecommerce platform sends an API name to the service, which immediately returns the proper tax price for that particular location.

Step 4: Perceive Product and Service Taxability

Simply as tax charges range by location, the taxability of products and companies varies by state. You can not merely apply the proper price to your complete sale. You should first decide which objects within the buyer’s cart are literally topic to tax.

Are Your Merchandise Taxable, Exempt, or Handled In a different way?

Most tangible private property (e.g., electronics, furnishings, toys) is taxable in each state with a gross sales tax. Nevertheless, many product classes have particular guidelines:

- Clothes: Some states, like Pennsylvania, totally exempt most clothes. Others, like New York, exempt clothes and footwear objects under a sure value ($110). Nonetheless others tax clothes on the full price.

- Groceries and Meals: Most states exempt “unprepared” meals or groceries, however the definitions could be tough. For instance, a bag of espresso beans could be exempt, however a ready cup of espresso can be taxable. Sweet is commonly taxable even when different meals shouldn’t be.

- Digital Items: It is a quickly evolving space. Some states totally tax digital downloads like ebooks, music, and streaming companies. Others don’t tax them in any respect, and a few are in a grey space.

- Providers: Most companies should not taxable, however some states tax particular companies like landscaping or inside design. For ecommerce, that is most related in the event you promote companies alongside merchandise.

Researching State-Particular Product Taxability Guidelines

Figuring out the taxability of your merchandise in each nexus state requires cautious analysis. You’ll find this info on state division of income web sites. Nevertheless, that is one other space the place automated gross sales tax software program offers immense worth. These methods have built-in “product taxability codes.” You’ll be able to assign a code to every of your merchandise (e.g., “clothes” or “digital good”), and the system will mechanically apply the proper tax guidelines for that product within the buyer’s state on the time of the sale.

Step 5: Acquire the Tax on the Level of Sale

As soon as you already know the place you’ve nexus, are registered, can decide the proper price, and perceive your product taxability, the ultimate step within the calculation course of is to really cost the tax throughout checkout.

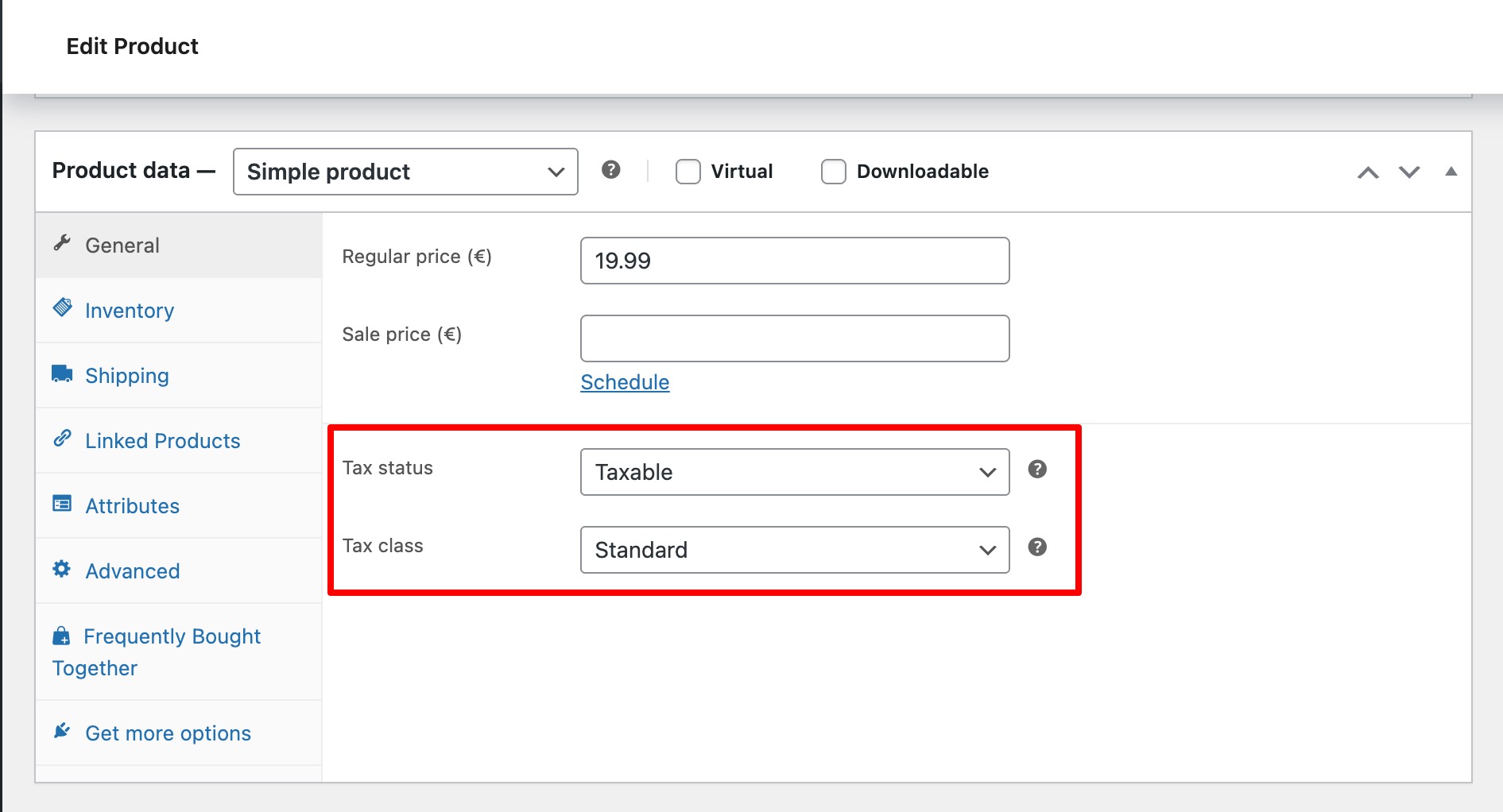

Configuring Your Ecommerce Platform

All main ecommerce platforms, whether or not you’re utilizing a complete web site builder platform like Elementor or one other resolution, have built-in tax settings. Nevertheless, their capabilities range:

- Primary Tax Tables: Some platforms require you to manually enter tax charges for states, counties, and cities. As we’ve mentioned, that is extremely impractical and vulnerable to error.

- Automated Integrations: The perfect strategy is to make use of a platform that integrates straight with a gross sales tax automation service. With a device like Elementor Professional, you’ll be able to construct a complicated retailer and join it to a devoted tax plugin. This plugin handles the real-time price calculations by way of API, guaranteeing each buyer is charged the correct quantity mechanically.

Displaying Gross sales Tax Clearly to Clients

It’s necessary to be clear along with your clients. Gross sales tax must be displayed as a separate line merchandise within the procuring cart and on the closing checkout display screen. This reveals the shopper precisely what they’re paying for and builds belief. Hiding the tax till the ultimate bank card entry display screen can result in cart abandonment.

Submitting, Remittance, and Staying Compliant

Amassing the tax is barely half the battle. You might be holding that cash in belief for the state, and it’s essential to report and remit it on an everyday schedule.

The Gross sales Tax Submitting Course of

After you register for a allow, the state will assign you a submitting frequency. That is usually primarily based in your estimated gross sales quantity.

Submitting Frequencies

- Month-to-month: For companies with excessive gross sales quantity.

- Quarterly: The most typical frequency for small and medium-sized companies.

- Yearly: For companies with very low gross sales quantity in a state.

It’s essential to know your submitting deadline for every state. Lacking a deadline may end up in penalties and curiosity.

Reporting and Paying the Collected Tax

Submitting a gross sales tax return entails reporting your whole product sales for the interval, your whole taxable gross sales, and the quantity of gross sales tax you collected. Most states require you to interrupt down your gross sales and picked up tax by native jurisdiction (county, metropolis, and so on.), which makes correct reporting important.

All states now require you to file and pay electronically by way of their on-line portal. You’ll switch the funds straight from what you are promoting checking account.

Managing Gross sales Tax Returns and Deadlines

When you have nexus in a number of states, you possibly can be dealing with a number of submitting deadlines each single month. Managing this manually is a big administrative burden. That is one more space the place automation is essential. Gross sales tax software program can observe all of your deadlines and even auto-file returns in your behalf, guaranteeing you might be all the time on time and correct.

The Significance of Correct File-Retaining

You should hold detailed information of all of your gross sales, the gross sales tax you collected, and the returns you filed. Within the occasion of an audit, you will want to have the ability to produce these information to show that you’ve got been compliant. Maintain these information for at the very least three to 5 years, relying on state necessities.

Leveraging Know-how and Automation

For any on-line enterprise promoting to greater than a handful of states, making an attempt to handle gross sales tax compliance manually shouldn’t be a sustainable technique. The complexity is just too excessive, and the chance of error is just too nice.

The Limitations of Guide Calculation

To recap, a guide strategy requires you to:

- Observe financial nexus thresholds in ~45 states concurrently.

- Monitor over 13,000 altering gross sales tax charges and limits.

- Analysis and keep up to date on product taxability guidelines on your particular items in each state.

- Handle dozens of various submitting deadlines and reporting necessities.

The time funding is gigantic, and the potential for pricey errors is nearly assured.

How Gross sales Tax Software program Simplifies Compliance

Automated gross sales tax software program (akin to Avalara, TaxJar, or Sovos) is designed to deal with this complete lifecycle for you. These platforms join on to your ecommerce retailer and different gross sales channels to:

- Monitor Nexus: Warn you if you find yourself approaching financial nexus thresholds.

- Calculate in Actual-Time: Present prompt, correct, address-level gross sales tax calculations at checkout.

- Deal with Product Taxability: Mechanically apply the proper guidelines primarily based on product codes.

- Compile Stories: Generate the detailed stories wanted for submitting returns.

- Automate Submitting: Mechanically file your returns and remit the tax funds in your behalf.

The price of these companies is a small value to pay for the peace of thoughts and accuracy they supply. Investing in a strong internet hosting resolution, like Elementor Internet hosting, ensures your web site has the efficiency to deal with these API calls seamlessly, even throughout high-traffic intervals.

Particular Issues and Superior Subjects

As you develop, chances are you’ll encounter extra nuanced gross sales tax conditions. Listed here are a couple of widespread ones.

Dealing with Gross sales Tax on Delivery and Dealing with Charges

The taxability of delivery fees varies by state.

- Some states take into account delivery taxable if the objects being shipped are taxable.

- Some states take into account delivery non-taxable so long as it’s said as a separate line merchandise on the bill.

- Some states have advanced guidelines the place delivery is taxable, however dealing with shouldn’t be, or vice-versa.

That is one other rule that automated tax engines deal with appropriately primarily based on the vacation spot state’s legal guidelines.

Managing Gross sales Tax Holidays

A number of states have annual “gross sales tax holidays,” usually for a weekend in late summer time. Throughout this era, particular objects—most frequently clothes, college provides, and computer systems under a sure value—are exempt from gross sales tax. Should you promote these things, your checkout system have to be configured to not cost tax on eligible merchandise to clients in these states through the vacation interval. It is a prime instance of a compliance element that could be very simple to overlook with a guide system.

Worldwide Gross sales and VAT/GST

Should you promote to clients outdoors america, you’ll encounter a unique set of tax guidelines, akin to Worth-Added Tax (VAT) in Europe or Items and Providers Tax (GST) in international locations like Canada and Australia. These are consumption taxes which can be structured otherwise from U.S. gross sales tax, and the compliance necessities are solely separate. When you have vital worldwide gross sales, you will want to analysis your obligations in these international locations.

Market Facilitator Legal guidelines

Should you promote merchandise by way of a market like Amazon, Etsy, or Walmart, you have to be conscious of market facilitator legal guidelines. These legal guidelines, now in impact in almost each state, require {the marketplace} (the “facilitator”) to tackle the duty of calculating, amassing, and remitting gross sales tax for all gross sales made by way of its platform.

It is a vital aid for sellers. In your Amazon gross sales, Amazon handles the gross sales tax. Nevertheless, it’s essential to know two issues:

- It solely applies to gross sales on that market. You might be nonetheless 100% chargeable for the gross sales tax on orders from your individual web site.

- The gross sales nonetheless depend in the direction of nexus. Although Amazon is remitting the tax, the gross sales quantity out of your Amazon exercise nonetheless counts towards a state’s financial nexus threshold. This implies your market gross sales can create a nexus obligation for you, requiring you to register and accumulate tax in your direct-to-consumer web site gross sales.

Knowledgeable Insights

Managing this advanced internet of rules requires a proactive and knowledgeable strategy. “The largest mistake on-line sellers make is ready till it’s too late,” says Itamar Haim, a number one skilled in ecommerce compliance. “They both ignore gross sales tax solely or they wait till they get a discover from a state. By then, they’re already dealing with a number of years of again taxes, plus penalties and curiosity. The secret is to be proactive. Perceive your nexus footprint from day one and have a scalable system in place earlier than you cross these thresholds. In 2025, automation isn’t a luxurious; it’s a foundational a part of a wholesome ecommerce enterprise.”

Getting ready for the Way forward for Gross sales Tax

The world of gross sales tax shouldn’t be static. It should proceed to evolve, and on-line companies have to be ready for what’s subsequent.

The Development In the direction of Digital Product Taxation

Because the financial system turns into extra digital, states are more and more seeking to tax digital items and companies to make up for declining income from conventional items. We will count on extra states to start taxing downloads, streaming companies, and software-as-a-service (SaaS) merchandise within the coming years. Should you promote digital merchandise, that is an space it’s essential to monitor carefully.

Rising Complexity and the Want for Strong Techniques

There isn’t a indication that gross sales tax will turn out to be easier. If something, the pattern is towards extra complexity, extra nuanced guidelines, and extra aggressive enforcement by states searching for to seize income. This reinforces the necessity for companies to maneuver away from guide processes and undertake sturdy, automated methods that may adapt to those adjustments. Constructing what you are promoting on a versatile platform that enables for highly effective integrations, akin to utilizing Elementor’s library of templates and instruments, provides you the agility to adapt your retailer as these necessities change.

Conclusion

Calculating gross sales tax on your on-line retailer is a formidable however manageable job. By breaking it down right into a logical sequence—understanding nexus, figuring out your obligations, registering for permits, implementing an correct calculation system, and staying on prime of submitting—you’ll be able to construct a compliant and resilient enterprise.

The secret is to interchange guesswork with course of and guide effort with automation. A proactive strategy to gross sales tax not solely retains you on the precise aspect of the legislation but in addition frees up your time and power to deal with what you do greatest: rising what you are promoting, delighting your clients, and constructing your model.

Ceaselessly Requested Questions (FAQ)

1. Do I want to fret about gross sales tax if I’m a really small enterprise? Sure. Gross sales tax obligations are primarily based on nexus, not the dimensions of what you are promoting. Whereas your low gross sales quantity may hold you underneath the financial nexus thresholds in most states, you possibly can nonetheless simply set off bodily nexus by utilizing a 3PL service or hiring a distant worker. It’s essential for each enterprise, no matter dimension, to know and monitor its nexus footprint.

2. What occurs if I’ve had nexus in a state for some time however by no means registered or collected tax? It is a critical state of affairs that requires cautious dealing with. You might be answerable for the uncollected again taxes, plus penalties and curiosity. The perfect plan of action is to seek the advice of with a tax skilled who focuses on gross sales tax. They will help you quantify your publicity and will suggest a Voluntary Disclosure Settlement (VDA). A VDA is a course of the place you proactively strategy the state to get compliant, and in return, the state usually agrees to waive penalties.

3. Is the gross sales tax price primarily based on the shopper’s billing tackle or delivery tackle? The gross sales tax price is nearly all the time primarily based on the delivery tackle. That is the “level of supply” the place the shopper takes possession of the products, and it’s what determines the precise state, county, and metropolis jurisdiction for tax functions.

4. My ecommerce platform has a setting for “cost tax on delivery.” Ought to I flip it on? It relies upon. The taxability of delivery is set by the principles of the vacation spot state. Some states require tax on delivery, whereas others don’t. Merely turning this setting “on” for all transactions will lead to over-collecting tax from clients in some states, whereas turning it “off” will lead to under-collecting in others. It is a good instance of why you want a complicated calculation engine that is aware of the precise guidelines for every state.

5. I solely promote digital merchandise. Can I ignore gross sales tax? Completely not. Whereas digital merchandise should not taxed as universally as bodily items, a rising variety of states have enacted legal guidelines to tax them. You should analysis the legal guidelines in each state the place you’ve financial nexus to find out in case your particular kind of digital product (e.g., e-book, software program, on-line course) is taken into account taxable.

6. Do I’ve to remit the precise quantity of gross sales tax I collected? Sure, with one small exception. Some states permit companies to maintain a tiny portion of the gross sales tax they accumulate as a “vendor’s low cost” or “well timed submitting low cost.” That is meant to compensate the enterprise for the price of amassing the tax. The quantity is normally very small (e.g., 1-2% of the tax due, capped at a certain quantity), and also you solely get it in the event you file and pay on time.

7. Can I take advantage of one state’s gross sales tax allow to gather tax for an additional state? No. You should have a separate, legitimate gross sales tax allow for every particular person state through which you accumulate gross sales tax. A allow from California is barely legitimate for amassing California gross sales tax.

8. What’s the distinction between gross sales tax and use tax? Gross sales tax is charged by the vendor on the time of buy. Use tax is paid by the buyer on to the state once they buy a taxable merchandise from a vendor who did not accumulate gross sales tax. In principle, in the event you purchase one thing on-line and aren’t charged gross sales tax, you might be presupposed to report and pay use tax on that buy in your state earnings tax return. Financial nexus legal guidelines had been created partially as a result of particular person use tax compliance was extraordinarily low.

9. Are gross sales to non-profit organizations or resellers tax-exempt? Sure, however it’s essential to accumulate and validate an exemption certificates from the customer. Should you make a tax-exempt sale to a reseller, for instance, it’s essential to have a replica of their legitimate resale certificates on file. With out that documentation, you’d be answerable for the uncollected tax in an audit. Managing exemption certificates is one other key operate of superior gross sales tax software program.

10. How usually ought to I examine my financial nexus standing? It’s best to evaluate your gross sales knowledge in opposition to state thresholds at the very least as soon as per quarter. Nevertheless, if what you are promoting is rising quickly, a month-to-month evaluate is far safer. Many companies are caught off guard as a result of they develop quicker than they anticipated and cross a threshold mid-year with out realizing it. Common monitoring prevents these sorts of surprises.